idaho inheritance tax rate

A state estate tax is derived from the total value of an individuals or decedentâs estate and how it measures up to the stateâs estate tax exemption. Knowing your income tax rate can help you calculate your tax liability for unexpected income.

Idaho Estate Tax Everything You Need To Know Smartasset

Idaho has no state inheritance or estate tax.

. No estate tax or inheritance tax. Like the Federal Income Tax Idahos income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. In 2004 the states estate tax also expired.

Maryland is the only state to impose both. No state income tax Note. Idaho state sales tax rate.

Idaho Inheritance and Gift Tax. Inheritances that fall below these exemption amounts arent subject to the tax. Idaho has one of the lowest median property tax rates in the United States with only thirteen states collecting a lower median property tax than Idaho.

For this to be reinstated either the Idaho Legislature or Congress would have to change the law. Any more than that in a year and you might have to pay a certain percentage of taxes on the gift. Plus 3125 of the amount over.

The idaho state sales tax rate is 6 and the average id sales tax after local surtaxes is 601. Twelve states and Washington DC. Idaho has no state inheritance or estate tax.

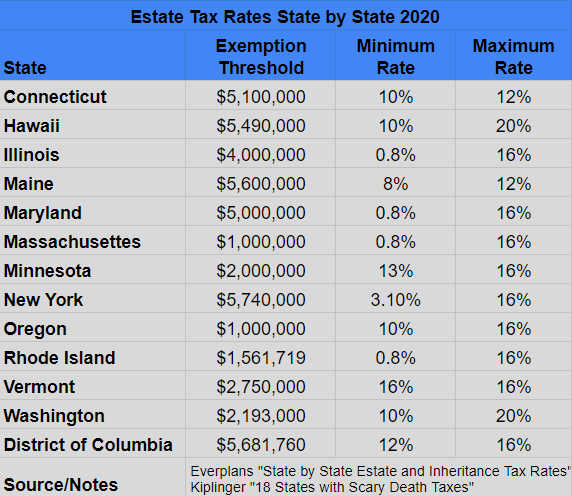

The top estate tax rate is 16 percent exemption threshold. As of 2018 an individual can give another person up to 15000 per year as a gift tax-free. An inheritance tax on the other hand is based on the beneficiaries their relationship to the decedent and the value of the estate that will pass to certain types of beneficiaries.

Idaho does not impose an inheritance or gift tax on the transfer of estate ownership. Idaho doesnt have an estate tax although it did at one time. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Key findings A federal estate tax ranging from 18 to 40. Idahos maximum marginal income tax rate is the 1st highest in the United States ranking directly. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

For complete notes and annotations please see the source below. However like all other states it has its own inheritance laws including the ones that cover. For more information see what are Idahos sales tax rate and our Use Tax brochure.

Plus 6625 of the amount over. Personal income tax rates 2017 State Tax rates Number of brackets Brackets Lowest Highest Lowest Highest Idaho. Plus 1125 of the amount over.

Idaho has a progressive income tax with rates ranging from 160 to 740. Idaho state property tax rate. Counties in Idaho collect an average of 069 of a propertys assesed fair market value as property tax per year.

Idaho also does not have an inheritance tax. Keep reading for all the most recent estate and inheritance tax rates by state. An individuals tax liability varies according to his or her tax bracket.

Plus 4625 of the amount over. Idaho Estate Taxes. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

Tax rates Personal income tax See also. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Idaho state tax rates Idaho state income tax rate.

For more information contact. However if you inherited assets from an individual who lived in another state you may still owe inheritance taxes to. During the waning days of the 2021 legislative session lawmakers altered the ability of municipalities to adjust their budgets based on new growth.

Tax Rate. The personal income tax rates in Idaho for the 2015 tax year ranged from 16 percent to 74 percent. Sarah FisherMar 03 2020.

A tax bracket is the income range to which a tax rate applies. The tax rate varies depending on the relationship of the heir to the decedent. The rates for Pennsylvania inheritance tax are as follows.

No estate tax or inheritance tax Illinois. The median property tax in Idaho is 118800 per year for a home worth the median value of 17170000. However like all other states it has its own inheritance laws including the ones that cover what happens if the decedent dies without a valid will.

Plus 5625 of the amount over. Impose estate taxes and six impose inheritance taxes. Estates and Taxes.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Idaho State Commission 800. 1 2005 contact us in the Boise area at 208 334-7660 or toll free at.

If you receive a large inheritance and decide to give part of it to your children the 15000 limit per year still applies. Idaho has no inheritance tax or gift tax. Plus 3625 of the amount over.

This article goes over topics that include probate how to successfully create a valid will in Idaho and what happens to your property if. Idaho collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Idahos property taxes are the 12th lowest in the country with an average effective rate of just 076.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. For more details on Idaho estate tax requirements for deaths before Jan.

Inheritance laws from other states may apply to you though if a person who lived in a state with an inheritance tax leaves something to you. In Kentucky for instance the inheritance tax applies to all in-state property even for out-of-state inheritors. In Idaho there are seven income tax brackets.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Estate Tax Everything You Need To Know Smartasset

Focus Shifts To State Estate Tax Planning Wsj

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Picking An Estate Planning Lawyer In Boise Is Sufficiently Simple When You Know Precisely What You Are Sea Estate Planning Estate Planning Attorney How To Plan

Idaho Estate Tax Everything You Need To Know Smartasset

Apa Arti Inheritance Tax Dalam Bahasa Indonesia

Idaho Realtors Work Hard To Support Private Property Rights Realtors Estate Tax Supportive

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

State Estate And Inheritance Taxes Itep

Recent Changes To Estate Tax Law What S New For 2019

4 Things You Need To Know About Inheritance And Estate Taxes

How Is Tax Liability Calculated Common Tax Questions Answered

States That Won T Tax Your Retirement Distributions Income Tax Income Tax

State Estate And Inheritance Taxes Itep

State Estate And Inheritance Taxes Itep

How To Avoid Estate Taxes With A Trust

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep