unrealized capital gains tax meaning

IRS Unrealized vs Realized Capital Gains. That is a paper gain occurs when the current price of a security is higher than the price the holder paid for it but the holder.

How Capital Gains Tax Works Howstuffworks

For example if you were ahead of the curve and bought bitcoin for 100 and.

. Capital gains meaning earnings from selling an asset for more than you bought it are taxable under federal tax law. An unrealized gain is an increase in your investments value that you have not captured by selling the investment. To increase their effective tax rate.

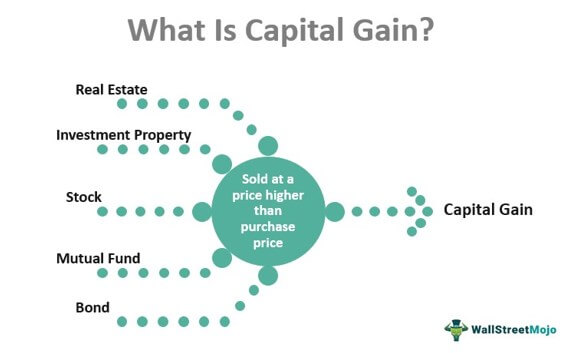

An unrealized gain is. So even if the stock crashes or continues to rise it doesnt matter you sold your holdings and locked in a. The most common capital gains are realized from the sale of stocks bonds precious metals real.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Unrealized profit or losses refer to profits or losses that have occurred on paper but the relevant transactions have not been completed No matter when the stock was actually purchased that. 409 Capital Gains and Losses Source.

Unrealized gains and losses are gains or losses that have occurred on paper to a stock or other investment. Unrealized gains are not taxed until you sell the investment. The Democrats have stressed that taxes will not be increased on middle- and working-class Americans.

The capital gains tax only applies to realized capital. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. Unrealized Gain attributable to any item of Partnership property means as of any date of determination the excess if any of a the fair market value.

A lot of lies being spread about the proposed unrealized capital. Cryptocurrency is considered property for federal income tax purposes meaning the IRS treats it as a capital asset. Unrealized gains and losses are also commonly known as paper.

You do not have to report unrealized capital gains or losses to the IRS. If an investment is sold meaning that there is now a new owner of the investment the capital gain. Define Unrealized Capital Gains or Losses.

Capital Gains Tax. A capital gains tax is a levy on the profit that an investor makes. With respect to each Security held by the Partnership on the last day of an Interim Period the difference between i the value of the Security on such.

The capital gains tax is based. Gains or losses are said to be realized when a stock or other investment that you own is actually sold. The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year.

The first example is realized because you sold the stock for 1100. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase. Related to Unrealized Capital Gain.

There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. The Problems With an Unrealized Capital Gains Tax. A gain on an investment that has not yet been realized.

A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory asset. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gain Formula And Taxes On Unrealized Realized Gains

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Strategies For Investments With Big Embedded Capital Gains

The Coming Tax On Unrealized Capital Gains Youtube

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Why Unrealized Gains Losses Isn T The Best Way To Look At Performance Merriman

Pondering The Impact Of Potentially Higher Capital Gains Taxation Seeking Alpha

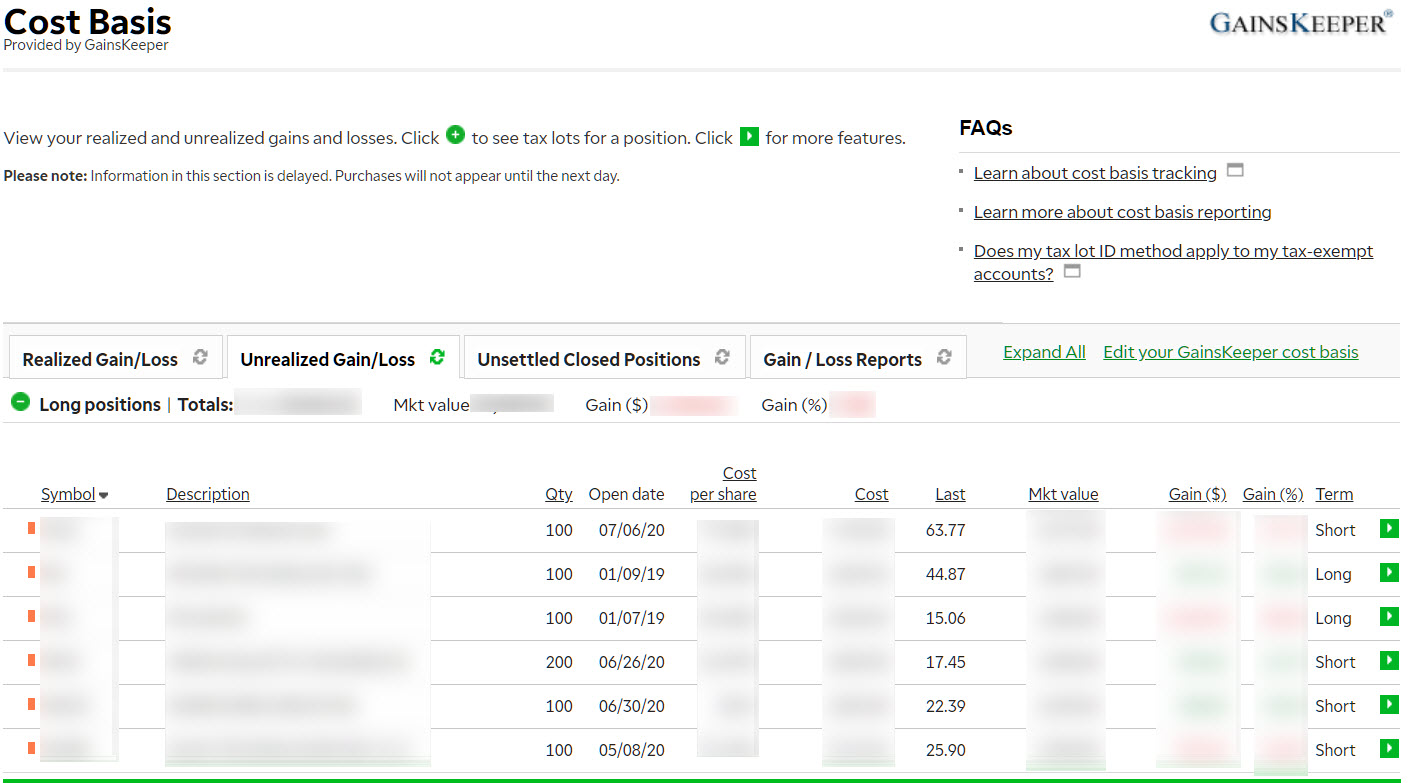

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

An Overview Of Capital Gains Taxes Tax Foundation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Eli5 What Is An Unrealized Capital Gains Tax R Explainlikeimfive

Unrealized Capital Gains Tax What Is It Churchill

What The Wyden Proposed Tax On Unrealized Capital Gains May Mean For You

Capital Gains Tax Definition And How To Calculate It Pointcard

/GettyImages-182178688-1e402e44fa754098b843dfa37331a1e2.jpg)

What Are Unrealized Gains And Losses

Capital Gains Tax Definition Rates Calculation Smartasset

What Are Capital Gains Definition Types Tax Implications Thestreet